refund for unemployment tax break

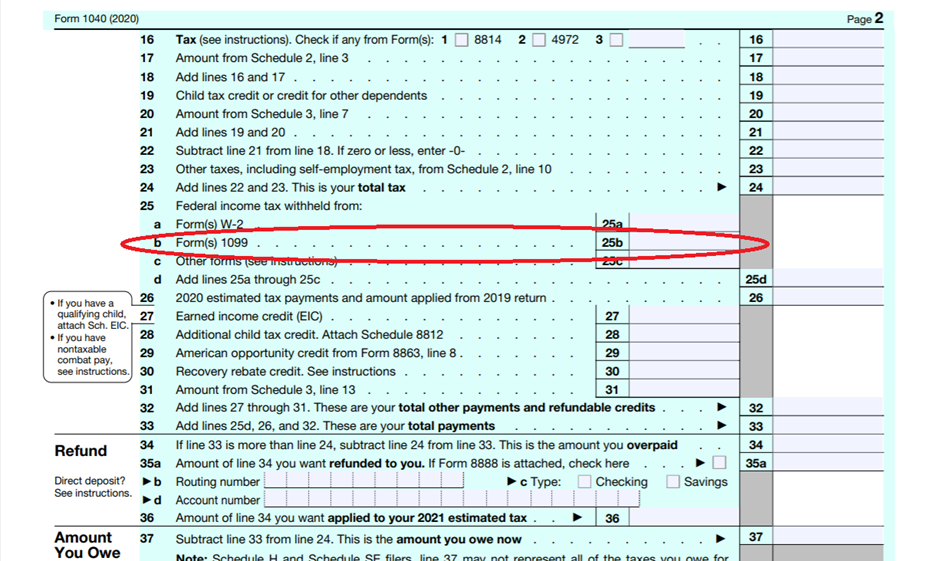

Unemployment Federal Tax Break. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

. The IRS has sent 87 million unemployment compensation refunds so far. We will mail checks to qualified applicants as. The American Rescue Plan which was signed into law by President Joe Biden on March 11 made the first 10200 of unemployment income tax-free for people with adjusted.

Few Tax Breaks Exist for K-12 Education. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Blake Burman on unemployment fraud.

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. If you received unemployment benefits in 2020 a tax refund may be on its way to you. The IRS announced earlier this month that the agency had begun the process of adjusting tax.

When Will The Irs Send Refunds For The Unemployment Compensation Tax Break. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax. Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid.

This means that you dont have to pay federal tax on the. The IRS has sent 87 million unemployment compensation refunds so far. The 10200 unemployment tax break was announced a couple of months back.

K-12 private school education expenses arent tax-deductible at the federal level at least not when theyre paid directly by parents. You are eligible for a property tax deduction or a property tax credit only if. Since May the IRS has issued over 87 million unemployment.

The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. Property Tax Relief Programs. The deadline for filing your ANCHOR benefit application is December 30 2022.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. We will begin paying ANCHOR. From then on weve received countless requests for an article to cover all the necessities regarding refunds.

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Usa

Irs Issues New Batch Of 1 5 Million Unemployment Refunds

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Confirmed Refunds For 10 200 Unemployment Benefit Tax Break To Start In May

Tax Refund Irs Says 2 8m Will Get Overpaid Unemployment Money Returned This Week Kxan Austin

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

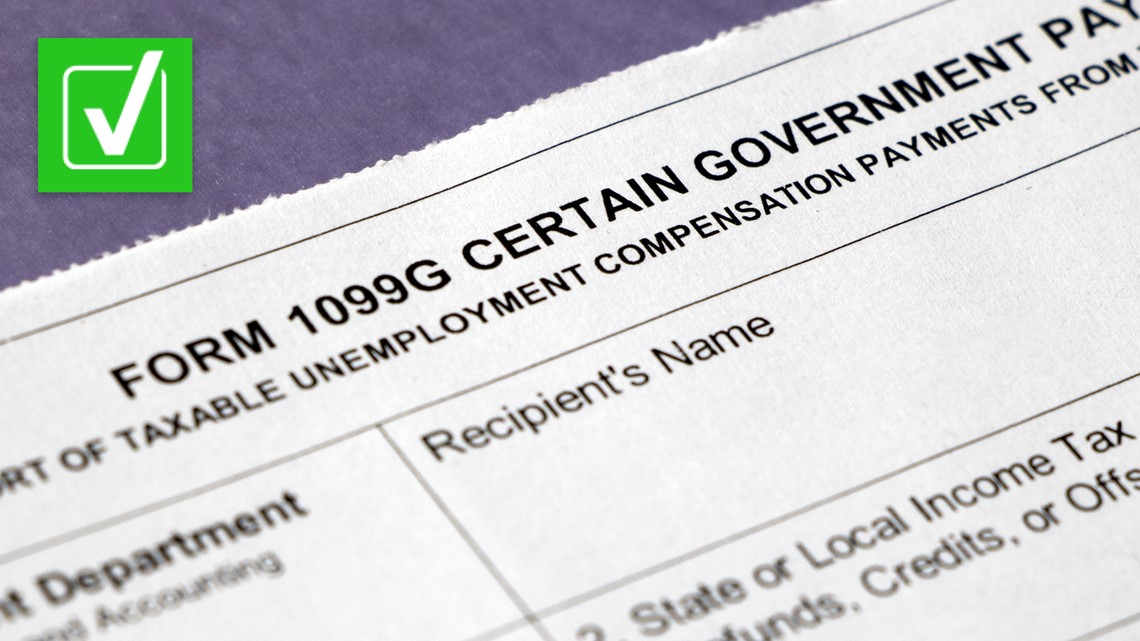

1099 G Unemployment Compensation 1099g

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

Amended Tax Return May Be Needed For Some Unemployed Workers Irs Says

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Unemployed Workers Could Get A Nasty Surprise At Tax Time

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

10 200 Unemployment Refund When You Will Get It If You Filed Taxes Early

Interesting Update On The Unemployment Refund R Irs

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

10 200 Unemployment Tax Break Refund How To Know If I Will Get It As Usa

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun